Does Shipping Tell the Real Story of China? You Should Hope Not

Does Shipping Tell the Real Story of China By Manisha Jha, GCaptain

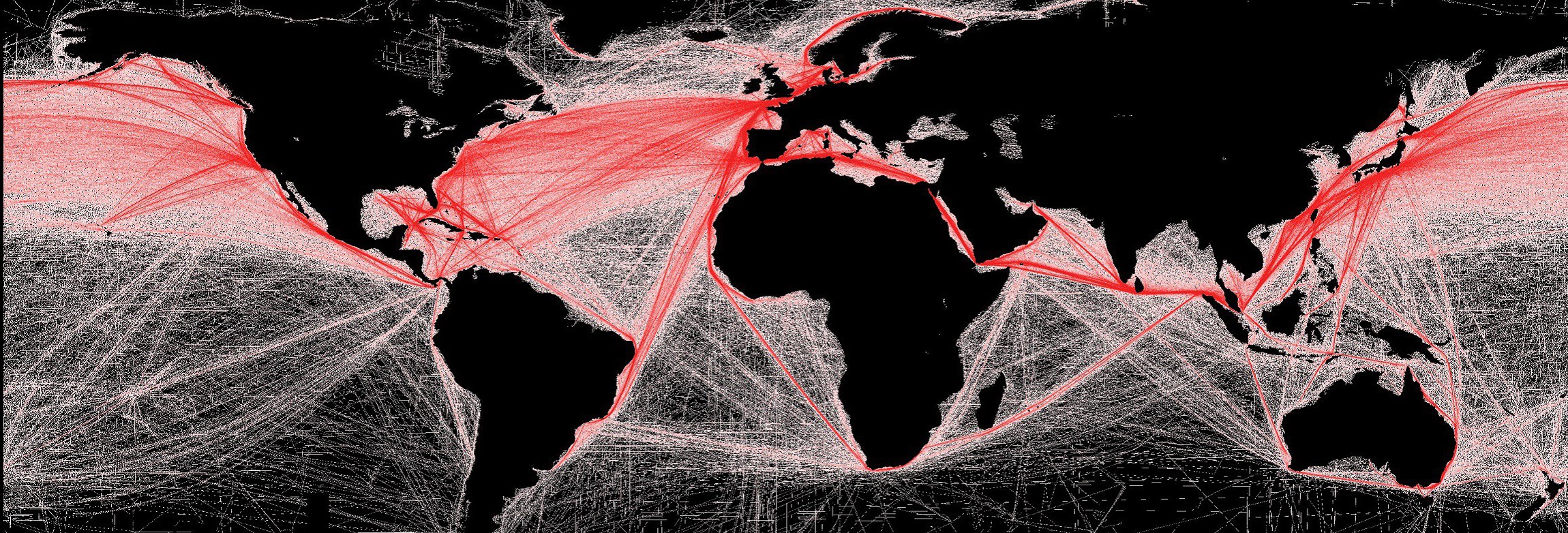

(Bloomberg) — Investors betting that China’s near- insatiable appetite for industrial raw materials will drive global economic growth may want to skip the shipping news.

For the first time in at least a decade, combined seaborne imports of iron ore and coal — commodities that helped fuel a manufacturing boom in the world’s second-largest economy — are down from a year earlier. While demand next year may be a little better, slower-than-anticipated growth in 2015 has led to almost perpetual disappointment for shippers, after analysts’ predictions at the end of 2014 for a rebound proved wrong.

The world has surpluses of everything from corn to crude oil, and commodity prices are heading for their biggest annual loss since the financial crisis. With China’s economy expanding at the slowest pace since 1990 demand has ebbed from one of the biggest importers. The Baltic Dry Index of shipping rates for bulk materials fell to an all-time low last month, turning those who watch the industry increasingly bearish.

“For dry bulk, China has gone completely belly up,” said Erik Nikolai Stavseth, an analyst at Arctic Securities ASA in Oslo, talking about ships that haul everything from coal to iron ore to grain. “Present Chinese demand is insufficient to service dry-bulk production, which is driving down rates and subsequently asset values as they follow each other.” Read Full Article >>

Discover ATMS for Cargo Shipping Training